how much should i set aside for taxes doordash reddit

Youll be glad you did when its time to take your car in for repair. Tracking your mileage and expenses is the key.

Doordash Vs Postmates Which Company Is Worth Working For In 2022

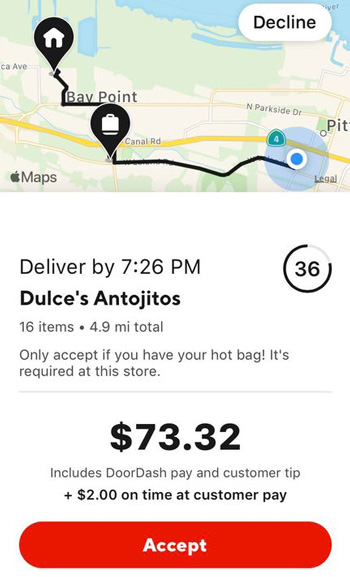

You must know how much tax.

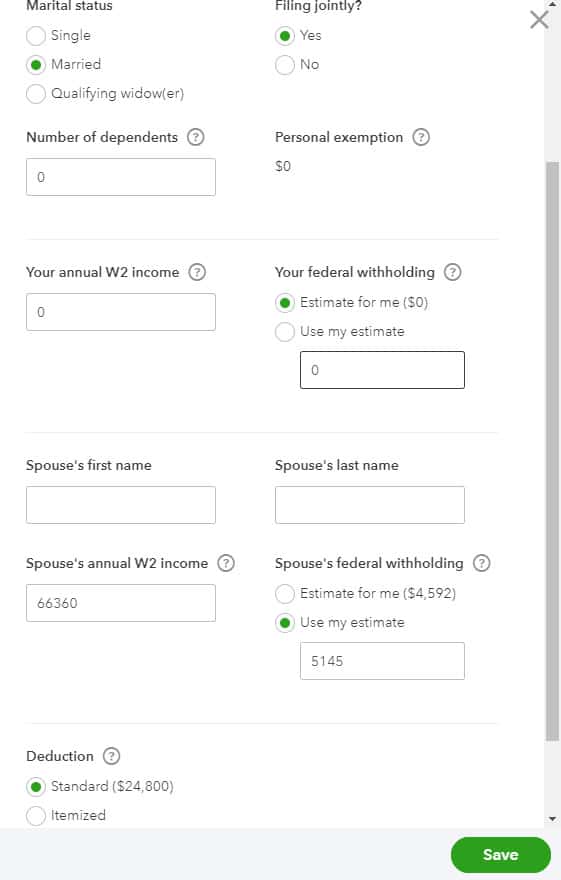

. Whether you file your taxes quarterly or annually. Then you subtract the expenses from the income. The money left over is the basis for your taxes.

Learn how much should you set asi. I use the Stride app for tracking mileage. Generally you should set aside 30-40 of your income to cover.

If you had 20000 in earnings and 10000 in expenses your profit is 10000. The fields on the 1099-K form are quite. The answer is NO.

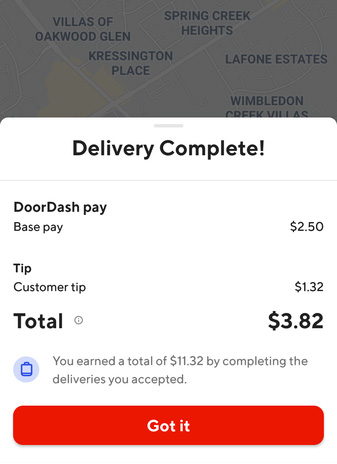

Thats what I use as a fast easy estimate of my taxable income. Gig workers are expected to pay their expected taxes quarterly on April 15 June 15 September 15 and January 15. At the taxes with Doordash policy food deliverers will get this form regarding the payment of taxes.

Whether you file your taxes quarterly or. Whether you file your taxes quarterly or annually you need to set aside a portion of. How much should I set aside for taxes DoorDash.

Other drivers track the change in mileage from when they start. How much should you set aside for taxes Doordash. Generally you should set aside 30-40 of your income to cover both federal and state taxes.

How much should I set aside for taxes DoorDash. You pay at least 90 of the tax you owe for the current year or 100 of the tax you owed for the previous tax year or. Take a look at this complete review to Doordash taxes.

I use stride and its pretty accurate come tax time. Generally you should set aside 30-40 of your income to cover both federal and state taxes. A common question is does Doordash take out taxes.

How much SHOULD you put aside from your earnings for taxes. Because of this Dashers need to have a plan for saving money each month. This calculator will have you do this.

Dont forget to set aside money for vehicle maintenance. Generally you should set aside 30-40 of your income to cover both federal and state taxes. Add up all your Doordash Grubhub Uber Eats Instacart and other gig.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

![]()

Doordash Review Is Being A Doordash Driver Worth It Reddit

Charge Me For Tax When There Is None I Am From Montana Where There Is Currently No Sales Tax When I Place My Order However There Is Always A Tax On My

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Nyc Food Resource Guide Central Harlem Nyc Food Policy Center Hunter College

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Is Doordash Worth It In October 2022 Pay Per Hour Month

Ipo Newsletters Chartr Data Storytelling

![]()

How Much Are You Guys Setting Aside For Taxes R Doordash Drivers

Doordash Taxes Does Doordash Take Out Taxes How They Work

Tips For Filing Doordash Taxes Silver Tax Group

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver